Secure Your Comfort With Reliable Home Insurance Coverage

Why Home Insurance Is Necessary

The significance of home insurance hinges on its capability to supply economic protection and comfort to property owners when faced with unpredicted events. Home insurance coverage works as a safeguard, providing protection for damages to the physical structure of your home, personal possessions, and obligation for mishaps that may happen on the property. In the event of all-natural calamities such as floods, fires, or quakes, having a thorough home insurance coverage plan can assist property owners recuperate and rebuild without encountering considerable monetary concerns.

In addition, home insurance policy is typically needed by home loan lenders to protect their financial investment in the property. Lenders intend to make certain that their economic rate of interests are protected in instance of any type of damage to the home. By having a home insurance coverage in position, home owners can satisfy this requirement and protect their investment in the property.

Kinds of Insurance Coverage Available

Offered the significance of home insurance in securing house owners from unanticipated monetary losses, it is crucial to comprehend the numerous kinds of coverage offered to tailor a plan that suits private demands and circumstances. There are a number of essential kinds of coverage used by most home insurance plans. Individual residential property coverage, on the other hand, safeguards personal belongings within the home, consisting of furniture, electronics, and garments.

Variables That Influence Premiums

Elements influencing home insurance coverage costs can differ based on a series of factors to consider details to individual situations. One considerable element affecting costs is the place of the insured residential property. Residences in areas prone to natural disasters such as earthquakes, typhoons, or wildfires generally draw in greater premiums due to the enhanced risk of damage. The age and problem of the home additionally play a crucial duty. Older homes or residential or commercial properties with outdated electrical, pipes, or heating unit may position higher threats for insurer, causing greater premiums.

Additionally, the insurance coverage restrictions and deductibles chosen by the policyholder can impact the premium quantity. Deciding for higher insurance coverage limitations or reduced deductibles normally results in greater premiums. The sort of construction products used in the home, such as timber versus brick, can likewise impact premiums as particular materials might be more prone to damage.

How to Choose the Right Policy

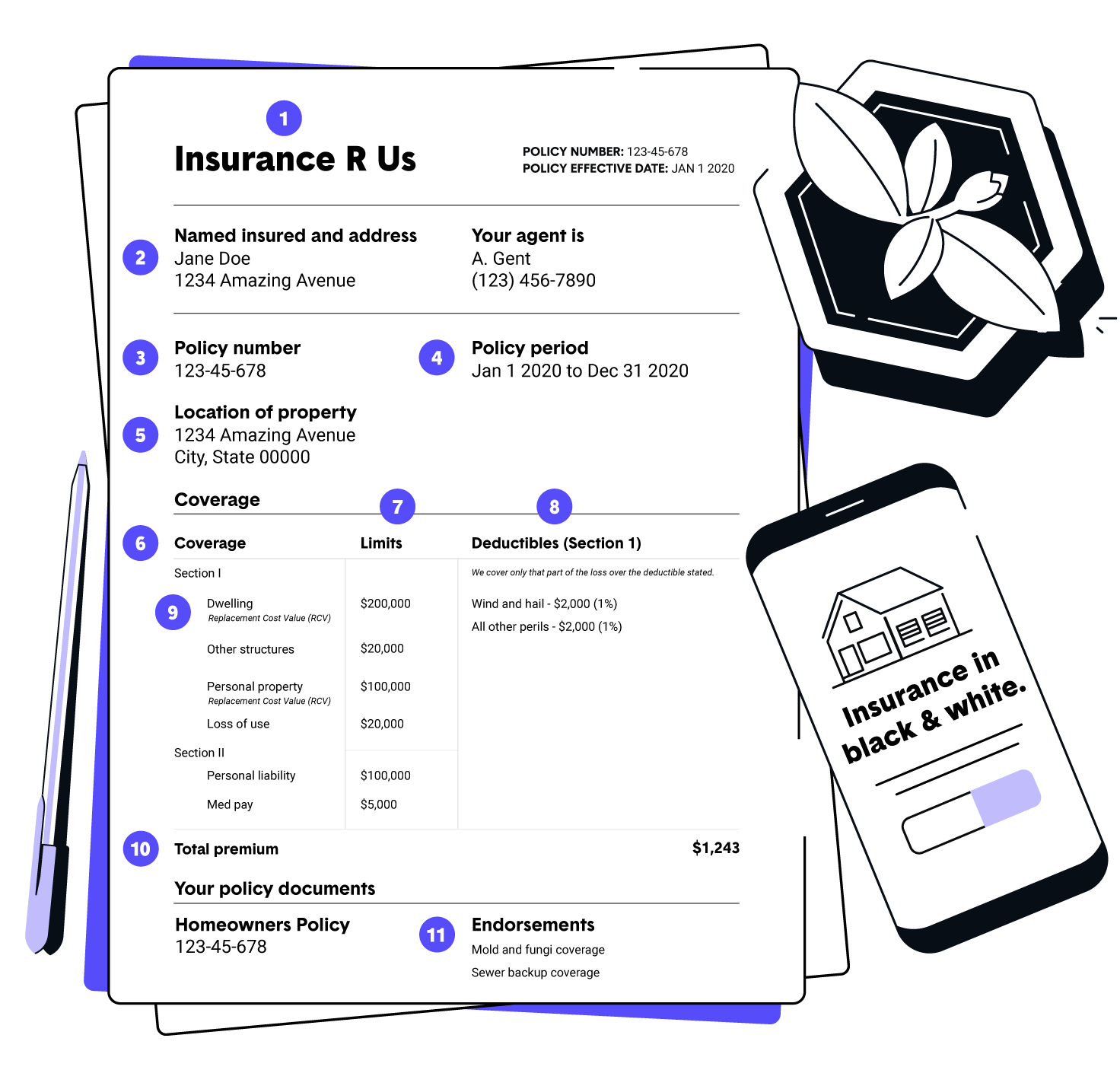

Selecting the appropriate home insurance coverage involves careful factor to consider of different crucial aspects to ensure comprehensive insurance coverage customized to private needs and situations. To begin, analyze the value of your home and its contents accurately. Recognizing the substitute cost of your residence and possessions will certainly aid determine the insurance coverage limitations required more in the plan. Next, take into consideration the different types of insurance coverage offered, such as home protection, individual building insurance coverage, liability defense, and added living costs coverage. Dressmaker these protections to match your particular demands and threat variables. Additionally, assess the policy's limits, exclusions, and deductibles to ensure they line up with your economic abilities and risk resistance.

In addition, evaluating the insurer's track record, economic security, consumer solution, and declares process is important. Try to find insurance firms with a background of reliable service and prompt cases negotiation. Lastly, compare quotes from several insurance providers to discover a balance between price and insurance coverage. By carefully reviewing these variables, you can select a home insurance policy that provides the essential security and comfort.

Benefits of Reliable Home Insurance

Trusted home insurance offers a complacency and defense for property owners versus unanticipated events and monetary losses. One of the vital benefits of reliable home insurance policy is the assurance that your property will certainly be covered in case of damage or devastation triggered by all-natural disasters such as storms, floods, or fires. This coverage can help homeowners avoid bearing the complete cost of repairs or rebuilding, providing tranquility of mind and financial stability during difficult times.

In addition, trustworthy home insurance policies commonly consist of responsibility protection, which can safeguard house owners from clinical and lawful expenses when it comes to mishaps on their residential or commercial property. This protection expands past the physical framework of the home to shield versus lawsuits and claims that may occur from injuries endured by site visitors.

In addition, having reliable home insurance can also add to a feeling of total health, recognizing that your most substantial financial investment is guarded versus numerous threats. By paying normal costs, house owners can mitigate the potential financial concern of unanticipated occasions, enabling them Home Page to focus on enjoying their homes without constant bother with what could occur.

Final Thought

To conclude, safeguarding a reliable home insurance coverage policy is important for protecting your residential or commercial property and belongings from unexpected occasions. By comprehending the kinds of protection available, variables that affect costs, and how to pick the best plan, you can ensure your tranquility of mind. Counting on a reputable home insurance copyright will supply you the benefits of economic protection and safety for your most valuable possession.

Browsing the realm of home insurance coverage can be complex, with different insurance coverage choices, plan factors, and considerations to consider. Understanding why home insurance coverage is essential, the types of coverage offered, and just how to choose the ideal plan can be pivotal in ensuring your most considerable financial investment continues to be protected.Provided the relevance of home insurance in securing homeowners from unexpected financial losses, it is vital to recognize the various types of protection offered to customize a plan that suits individual demands and circumstances. San Diego Home Insurance. There are a number of crucial kinds of insurance coverage supplied by most home insurance policies.Selecting the suitable home insurance policy includes mindful factor to consider of numerous key aspects to ensure comprehensive coverage customized to specific demands and circumstances

Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Joshua Jackson Then & Now!

Joshua Jackson Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now!